Notes to Financial Statements are literally written notes. It is a letter or written message about financial statements. Notes are written It is for the readers to understand a particular matter better. The purpose of notes to financial statements is to let the statements or documents function alone. For instance, the sticky notes on a computer that has the details of how the daily tasks are performed. These notes are intended for the next shift to know what tasks are accomplished. Moreover, what other tasks need to work on, and other matters regarding the task.

Notes to financial statements are a part of Financial Statements. They go together for the readers to interpret the standing of the business. It is an explanation of how the financial statements are made. Moreover, the valuation, and how they arrive at the figures. In addition, the status of every account. Because the valuation of accounts includes contingencies, assumptions, maturities, and other events affecting the financial affairs.

What should be included in notes to financial statements?

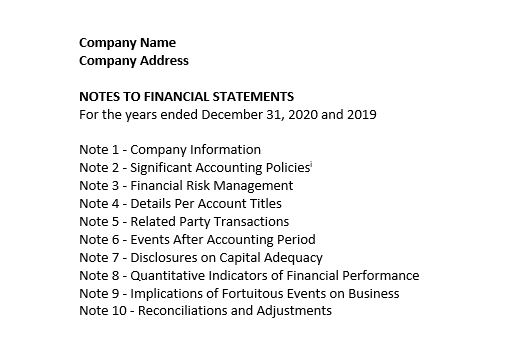

The external auditor may include or exclude any of the stated below. It depends on how the audit is. Moreover, if the company is under due diligence, or with a special purpose audit. In addition, if the government agencies require other matters related to financial audits. The auditor has to add financial notes to the financial statements. These are the notes to financial statements, but not limited to the following:

- The period applicable to the notes

- Company Information

- Significant Accounting Policies

- Management Accounting Judgments and Estimates

- Financial Risk Management

- Details Per Account Titles

- Related Party Transactions

- Events After the Accounting Period

- Disclosures on Capital Adequacy

- Quantitative Indicators of Financial Performance

- Implications of Fortuitous Events on Business

- Reconciliations and Adjustments

The period applicable to the notes to financial statements

It is important. Because it tells the reader what specific financial statements periods. Moreover, the date it is intended for use.

Company Information

The company information includes the name of the company and the address. In addition, what, when, and where it is registered for sole proprietor and partnership. What, when, and where it is incorporated if a corporation. It also includes the industry and the purpose of the business. It also includes the date. Moreover, released approval of the financial statements to the external auditor for audit purposes.

Significant Accounting Policies

This includes a summary of more significant policies and practices. Policies – the company set forth in facilitating financials. Moreover, in understanding the data in the financial statements. This note includes:

1.)Basis of preparation of notes to financial statements

The basis is the Financial Reporting Standards (PFRS). PFRS adopted by the Financial Reporting Standards Council (FRSC) from the pronouncements issued by the International Accounting Standards Board. And approved by the Philippine Board of Accountancy. The basis of preparation example is the going concern principle. It contemplates the realization of assets and settlement of liabilities in the normal course of business.

2.) Currency of Presentation

It is for some big companies that transact in multicurrency. The uniformity of currency is important factor. This is to prevent misleading financials. The accounts with foreign currency are converted at the time the financial statements were prepared. Others convert it on an average basis

3.) Presentation of Financial Statements

this explains the order of the financial statements. For instance, the financials are based on liquidity order. This note also includes the analysis of accounts within 12 months after the reporting date (current) and more than 12 months after the reporting date (non-current).

4.) Changes in Accounting Policies and Disclosures

Changes in accounting policies and disclosures are discuss in the notes. This note states the changes in the PFRS or Philippine Accounting Standards (PAS). It will also explain if the changes in the accounting policies have any significant impact on the financial position or performance of the company or not.

5.) Fair Value Measurement

Fair value is the price to sell an asset. Otherwise paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value measurement is based on the presumption that the transaction is to sell the asset. Otherwise transfer the liability takes place either: a.) in the principal market for the asset or liability, or b.) in the absence of a principal market, in the most advantageous market for the asset or liability. The principal or the most advantageous market must be accessible to the company.

The fair value of an asset or a liability is in the assumptions that market participants would use when pricing the asset or liability. This is assuming that market participants act in their economic best interest. If the asset or liability measured at fair value has a bid and ask price. This is the price acceptable to the creditors or market.

6.) Classification, Measurement, and Reclassification of Financial Assets and Liabilities

Financial assets are classified, at initial recognition, then measured at amortized cost, FVTOCI, and FVTPL. The classification and measurement depend on the financial asset’s contractual cash flow characteristics. Moreover, the company’s business model for managing them. The basis of classification and measurement is under PFRS 9 or IFRS 9. Accounting Standards are subject to change. The auditor must refer to the updated PFRS or IFRS when preparing financial statements. The International Financial Reporting Standards (IFRS) adopted in the Philippines. The changes that the IFRS will make are the same as the Philippine Standards.

Reclassification of financial assets is applicable if the objective of its business model for managing those financial assets changes. The change in the objective of the company’s business model must be effected before the reclassification date. The reclassification date is the beginning of the next reporting period following the change in the business model. The classification, measurement, and reclassification of accounts in the financial statements are detailed individually.

Significant Accounting Policies

The preparation of financial statements following PFRS requires the management to make judgments. Moreover, estimates that affect the reported amounts of financial accounts and disclosures of contingent accounts at the reporting date. Examples of judgment are the estimated useful life, estimated allowance, and others assumptions.

Financial Risk Management

The notes include financial risk management because taking the risk is core to the financial business. But some risks are inevitable like operational risks. The company will write all these risks in the notes including the control measures. In addition, the policies, commitments, and regulatory frameworks.

Details Per Account Titles

The details per account are important factor. The comparison of the previous year to the current year is written in the notes per accounts. It also includes earnings per share/book value per share of the corporation. Moreover, taxes if there are changes. The changes will affect the following reporting period.

Related Party Transactions

Related party relationship exists when one party can control, directly, or indirectly through one or more intermediaries. The other party may exercise significant influence over the other party in making financial and operating decisions. Related parties involved are also in the notes to financial position.

Events After the Reporting Period

The company will write in the notes the events that will occur after the date of the financial statements. Especially the one that will affect the financial affairs of the business.

Disclosures on Capital Adequacy

It is also a part of the notes. The explanation of capital adequacy computation. It will also show the possible results of the company’s future decisions that will affect the adequacy of capital. The plans should be congruent to capital adequacy. The capital should be sustainable and other matters.

Quantitative Indicators of Financial Performance

These are the amounts or rates. The written note could be the amount or rate of income and expense. Debt to equity ratio. The ratio will depend on what industry of the business. The significance to the business industry will be the key indicator of financial performance.

Implications of Fortuitous Events on Business

The notes will state the effect of the fortuitous events in the business. For instance, the covid19 fortuitous event. The notes explain in detail the effect as well as the impact of the events on the business. It will also state the possibilities if the events will take longer. Moreover, the adjustments if there will be a relief or loss.

Reconciliations and Adjustments

This is the last part. The action made or action the company will make with regards to all the stated above. Reconciliation of accounts such as due from banks, accounts receivables, accounts receivables, and other reconciling items in an account. It includes the adjustments last year. Moreover, and the adjustments in the current year.

How to use the Notes to Financial Statements?

The notes to financial statements have a reference, footnote etcetera. Follow the reference, guidelines, or footnotes written in the notes in using the notes to financial statements. Otherwise, it is arranged based on how useful the notes are. For notes to accounts, it is arranged based on liquidity.

Are notes to Financial Statements a part of Financial Statements?

Yes, it is a part of Financial Statements. Some financial statements presentations present the notes as separate financial statements. The notes are essential in reading the balance sheet. That’s why most preparers input notes to financial statements as a part of the balance sheet.

Are Notes to Financial Statements required by GAAP?

Yes, GAAP requires additional information to the financial statements. It is a part of the financial statement. It is there so that the readers understand the content of the financial statements. Here are some reasons why it is required. The measurement – the readers should understand how the record arrives at the figures in the financial statements. What are the computations, basis, guidelines used etcetera? Another reason is to assess the status and standing of financial statements with regard to the market. Moreover, fair value is observance in the market. Notes to financial position – used in decision-making purposes.

Related Blog: Accounting Best Practice and GAAP Compliance; Bookkeeping Services