Bonds payable is a debt instrument. The issuance of bonds has an issuer, the debtor, and a holder, the creditor. The bonds certificate represents a promise to pay the sum of money at the maturity date. Moreover, the periodic interest is on the maturity amount (face value) at a specific rate. When the amount of capital needed is too large for an individual to supply, businessmen borrow money from several investors. The borrowings of money from several investors can be made by bond issuance. Normally, bonds are issued on several certificates. Each certificate with a P1,000 face value. The interest payment is usually semi-annually or annually. A bond indenture is a contract or legal document that contains the agreement of the issuer and the bondholder. Bond indenture includes the face amount, the stated interest rate, and the date of periodic interest payment. Moreover, the date of maturity.

When you issue a bond, you will receive cash and recognize a liability at the same time. Stated, coupon or nominal rate is equal to the rate written in the bond indenture. The bond issuer sets the rate. Remember that the stated rate written in the bond is irrevocable regardless of the change in economic condition. That’s why in the sale of bonds, the basis of the transaction is the market rate. Market rate or effective yield is equal to the rate that is acceptable to the creditor. The rate should provide a return commensurate to the issuer’s risk. The relation of stated and market rates is the computation of interest. The computation of periodic interest paid to the bondholder each period is based on the stated rate (stated rate multiplied by the face amount of the bond). Market rate – used for the computation of discount or premium amortization.

Discount or Premium on Bonds Payable

We mentioned that the stated interest rate written in the bond indenture is irrevocable regardless of economic condition. The question is why do creditors agree to lend money given that the stated interest rate of the bond is irrevocable. The answer is that the bonds can be sold at a discount or premium. This means that when the market rate is higher than the stated rate, the bonds are sold at a discount.

On the other hand, the bonds are sold at a premium when the market rate is lower than the stated rate. When the bond is sold at discount, the cash received by the debtor is lower than the face amount of the bond. Moreover, when the bond is sold at a premium, the cash is more than the face value of the bonds. Another question is how to compute the cash proceeds of the bonds sold. The computation is based on the market or yield rate. First, we get the present value of the principal. Then, we get the present value of the ordinary annuity of the periodic interest payment. The total of the present value of principal and the present value of periodic interest will be the cash proceeds.

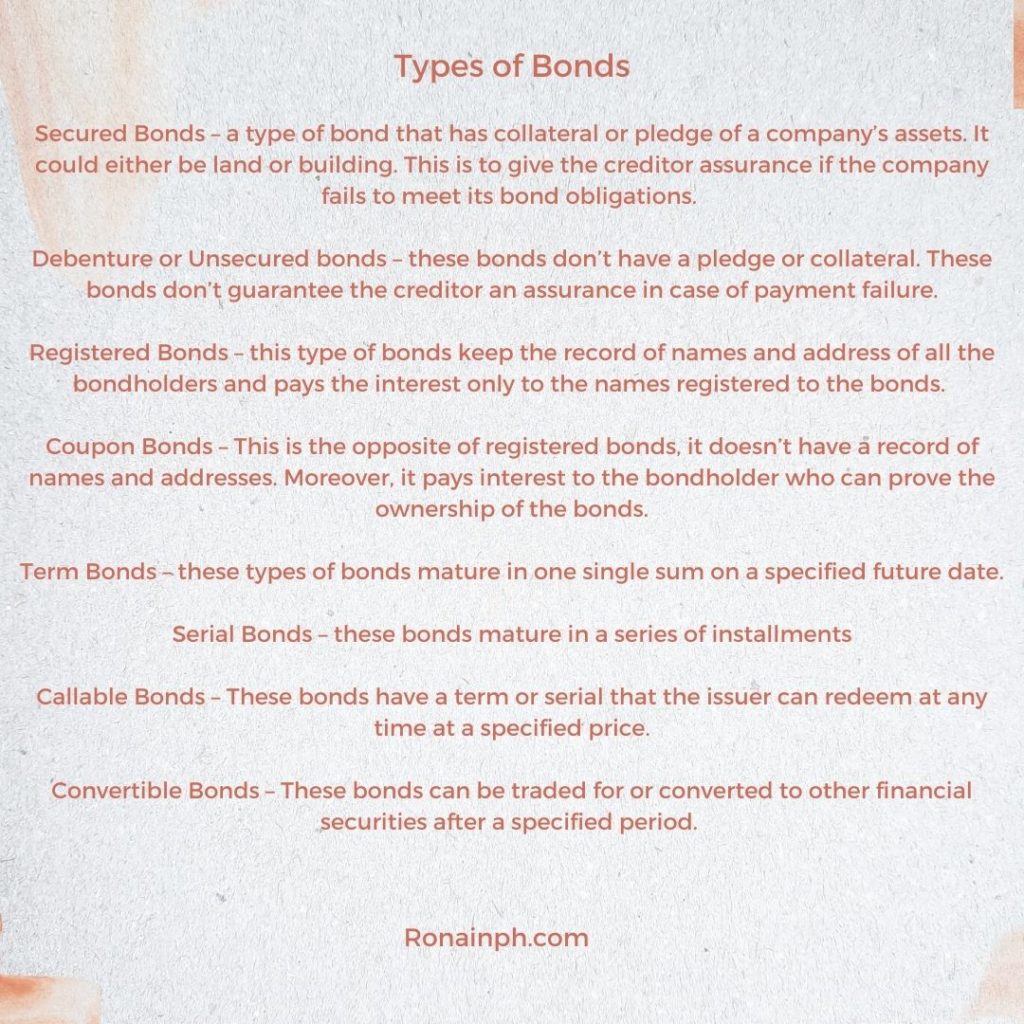

Types of Bonds Payable

Secured Bonds Payable

A type of bond that has collateral or pledge of a company’s assets. It could either be land or building. This is to give the creditor assurance if the company fails to meet its bond obligations.

Debenture or Unsecured bonds Payable

These bonds don’t have a pledge or collateral. These bonds don’t guarantee the creditor an assurance in case of payment failure.

Registered Bonds

A type of bond that keeps the record of the names and addresses of all the bondholders and pays the interest only to the names registered to the bonds.

Coupon Bonds

This is the opposite of registered bonds, it doesn’t have a record of names and addresses. Moreover, it pays interest to the bondholder who can prove the ownership of the bonds.

Term Bonds

these types of bonds mature in one single sum on a specified future date.

Serial Bonds

Bonds mature in a series of installments.

Callable Bonds

These bonds have a term or serial that the issuer can redeem at any time at a specified price.

Convertible Bonds

These bonds are called traded bonds. Otherwise, converted to other financial securities after a specified period.

Conclusion

Bonds Payable stated rate is irrevocable. In addition, bonds payable can be sold at market rate by selling on either discount or premium. Bonds payable have 8 types namely secured, debenture, registered, term, serial, callable, and convertible bonds. Moreover, the cash proceeds are the sum of the present value of principal and the present value of an ordinary annuity of periodic interest.

Related Blog: Liabilities

Learn more about Notes Payable